W4 paycheck calculator 2023

You will have to pay between 009 and 62 rates for the first 7700 of each employee in one calendar year. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Pin On Budget And Finance

Thats where our paycheck calculator comes in.

. Ad Compare Prices Find the Best Rates for Payroll Services. Free salary hourly and more paycheck calculators. Use e-Signature Secure Your Files.

That result is the tax withholding amount. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Make Your Payroll Effortless and Focus on What really Matters.

The rates vary depending on your industry. Then simply click Create W-4 and you are done. Moreover if you are a.

Enter your new tax withholding. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. 250 and subtract the refund adjust amount from that.

You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding. Contact a Taxpert before during or after you prepare and e-File your Returns. On the other hand if you make more than 200000 annually you will pay.

Or keep the same amount. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. In a few easy steps you can create your own paystubs and have them sent to your email.

To change your tax withholding amount. We use the most recent and accurate information. 250 minus 200 50.

In case you got any Tax Questions. Continue to monitor the tax withholding amount of your subsequent paychecks and make necessary adjustment via the W-4-Check tool. Try it for Free Now.

This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed Expense. Then look at your last paychecks tax withholding amount eg. Ad Create professional looking paystubs.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. TurboTax offers a free suite of tax calculators and tools to help save you money all year long. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Upload Modify or Create Forms. This calculator is integrated with a W-4 Form Tax withholding feature. Use your estimate to change your tax withholding amount on Form W-4.

Simple Weekly Hourly Habit Tracker Planner Weekly Schedule Etsy Daily Planner Printable Printable Planner Simple Weekly Planner

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

2022 Budget Planner Worksheets Free Printable Printables And Inspirations Budget Planner Budget Planner Worksheet Budgeting

Yearly Schedule Of Events Template Event Calendar Template Event Planning Calendar Planning Calendar

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Social Security Changes That May Be Coming For 2023 Gobankingrates

Download The Mortgage Payoff Calculator With Line Of Credit From Vertex42 Com In 2022 Mortgage Payoff Pay Off Mortgage Early Mortgage Amortization Calculator

2022 2023 Meal Planner Templates Pack 65 In 1 Bundle Meal Etsy Planner Template Meal Planner Template Recipe Book Templates

Tf Publishing Large 2023 Super Stripe Planner In 2022 Large Planners Planner Yearly Planner

Calculator And Estimator For 2023 Returns W 4 During 2022

How To Determine Your Total Income Tax Withholding Tax Rates Org

Calculator And Estimator For 2023 Returns W 4 During 2022

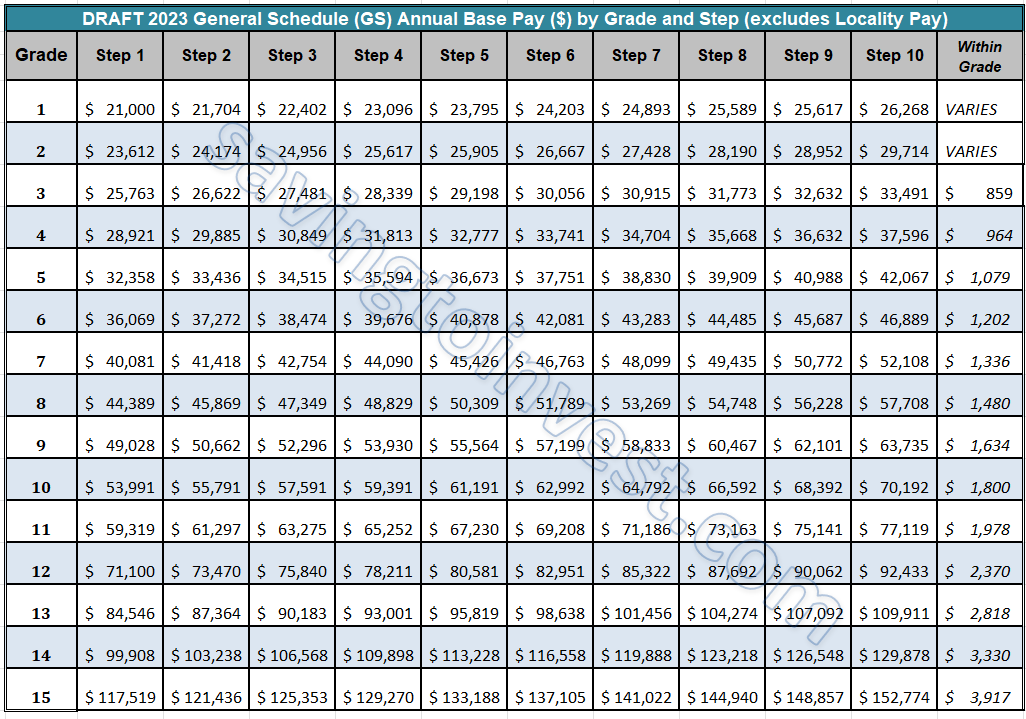

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Ultimate Life Binder Goal Planner Printable Planner Daily Etsy Life Binder Goal Planner Printable Goals Planner

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Wedding Budget Spreadsheet Best 2023 Templates For Wedding Planning Wedding Budget Spreadsheet Budget Spreadsheet Budgeting